Amanda Hall Blog

Sunday, July 15, 2018

Cyber Protection Information - eConveyancing Newsletter

from Upcoming Events https://www.aicnational.com.au/news/425/77/Cyber-Protection-Information-eConveyancing-Newsletter

ATO Obligations for Conveyancing Workshop

from Upcoming Events https://www.aicnational.com.au/news/424/77/ATO-Obligations-for-Conveyancing-Workshop

Sunday, July 8, 2018

Cyber Protection Information - eConveyancing Newsletter

from Upcoming Events http://www.aicnational.com.au/news/425/77/Cyber-Protection-Information-eConveyancing-Newsletter

ATO Obligations for Conveyancing Workshop

from Upcoming Events http://www.aicnational.com.au/news/424/77/ATO-Obligations-for-Conveyancing-Workshop

Wednesday, June 27, 2018

eConveyancing Australia - Edition 1

from Upcoming Events http://www.aicnational.com.au/news/423/77/eConveyancing-Australia-Edition-1

Monday, March 12, 2018

Property Grants available in 2018

FIRST HOME BUYERS ASSISTANCE SCHEME

The First Home Buyers Assistance scheme is a NSW Government initiative which provides exemptions or concessions on Stamp Duty for eligible NSW first home buyers. This includes vacant land on which you intend to build your first home.

First home buyers can apply to receive:-

- Exemptions from stamp duty on new and existing homes up to $650,000

- Concessions on Stamp Duty for new and existing homes between $650,000 and $800,000

- Eligible purchasers buying a vacant block of residential land to build their home on will pay no Stamp Duty on vacant land valued up to $350,000, and will receive concessions on duty for vacant land valued between $350,000 and $450,000.

To qualify for First Home Buyers Assistance, you must meet the criteria listed below:

- The contract and the transfer must be for the purchase of the whole of the property.

- All purchasers must be ‘eligible purchasers’. An ‘eligible purchaser’ is a natural person (i.e. not a company or trust) at least 18 years of age who has not, and whose spouse/de facto has not:

- at any time owned (either solely or with someone else) residential property in Australia other than property owned solely as trustee or executor

- previously received an exemption or concession under First Home—New Home.

- At least 1 eligible purchaser must occupy the home as their principal place of residence for a continuous period of 6 months, commencing within 12 months of completion of the agreement. (Where an eligible purchaser was a member of the permanent forces of the Australian Defence Force and all purchasers were enrolled on the NSW electoral roll, as at the transaction date, then all purchasers are exempt from the residence requirement).

First Home Owners Grant (New Homes)

First home buyers building a new property may be entitled to a $10,000 grant on homes worth up to $750,000.

First home buyers purchasing a brand new property worth up to $600,000 may be entitled to a $10,000 grant.

The criteria to be eligible for the First Home Owner Grant are:-

- at least one buyer must be an Australian citizen or permanent resident

- the agreement must be for the purchase of the whole property

- you must be a natural person (not a company or trust)

- you must be over 18

- the home is a brand new home

- you or your partner have not previously owned property in any form in Australia

- at least one purchaser must occupy the home within 12 months and needs to live in the home for a continuous period of at least 6 months

- you have not previously received a First Home Owners Grant in any State or Territory.

If you would like to know more about these benefits, please contact Revenue NSW or our office.

The post Property Grants available in 2018 appeared first on Conveyancing Conversations.

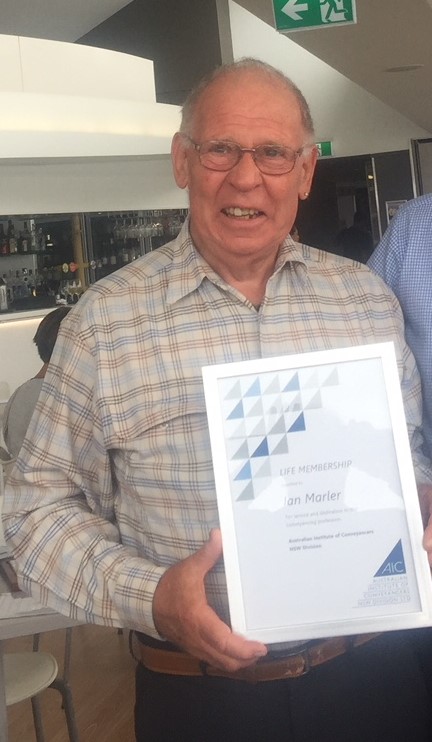

IAN MARLER RECOGNISED BY AUSTRALIAN INSTITUTE OF CONVEYANCERS NATIONAL AND STATE DIVISIONS

Ian Marler has been inducted as a Fellow into the Australian Institute of Conveyancers (AIC) and has also been awarded a Life Membership into the NSW Branch of the Institute for his tireless efforts and expertise in the Conveyancing industry.

Adamstown, NSW, March 8, 2018– Conveyancing Services is proud to announce that one of our founders, Mr Ian Marler, has been awarded both a Fellowship with the National Division of the Australian Institute of Conveyancers and a Life Membership with the NSW Division. Ian started one of the first conveyancing firms in the Hunter region, Conveyancing Services, in Denison Street in 1986 and later moved to Adamstown and expanded to Maitland. Ian was instrumental in having conveyancing recognized as a stand alone profession outside of solicitors and has long been well regarded in the industry. Ian is one of only five people to receive a Fellowship with the AIC and the only one from Newcastle.

Natalie Mason, who began working with Conveyancing Services in 2001 and is now a Co-Owner of the business, says “Ian is an amazing conveyancer who is extremely generous with his knowledge and his time and we are incredibly grateful for his contribution to conveyancing.”

Ian is a very well respected gentleman in Newcastle and many industries and has vast knowledge which is he always willing and available to share with anyone seeking to further their own interest in conveyancing. Ian is a Founding Member of the Australian Institute of Conveyancing, NSW Division, a Registered Surveyor and continues to be an asset to the local community with his services as a Justice of the Peace.

Kat Bell, who started at Conveyancing Services in 2010 and commenced studying for her conveyancing licence in 2011 says “Ian is a wonderful person who was part of the reason that I decided to aim for my conveyancing licence. He was always available for any questions I had and continues to be an inspiration in my career and a great friend.”

The post IAN MARLER RECOGNISED BY AUSTRALIAN INSTITUTE OF CONVEYANCERS NATIONAL AND STATE DIVISIONS appeared first on Conveyancing Conversations.